Know how best to trade, hold and sell Ethereum

Author’s snapshot of the Ethereum Homepage

There are best practices in Ethereum investment that you should know in order to minimize losses and maximize gains.

People who invested in cryptocurrencies such as Bitcoin as early as 2013 were fortunate. For instance, the values of many cryptocurrencies appreciated with over 100% in 2017 and 2018. What about most of us who missed our Bitcoin opportunity?

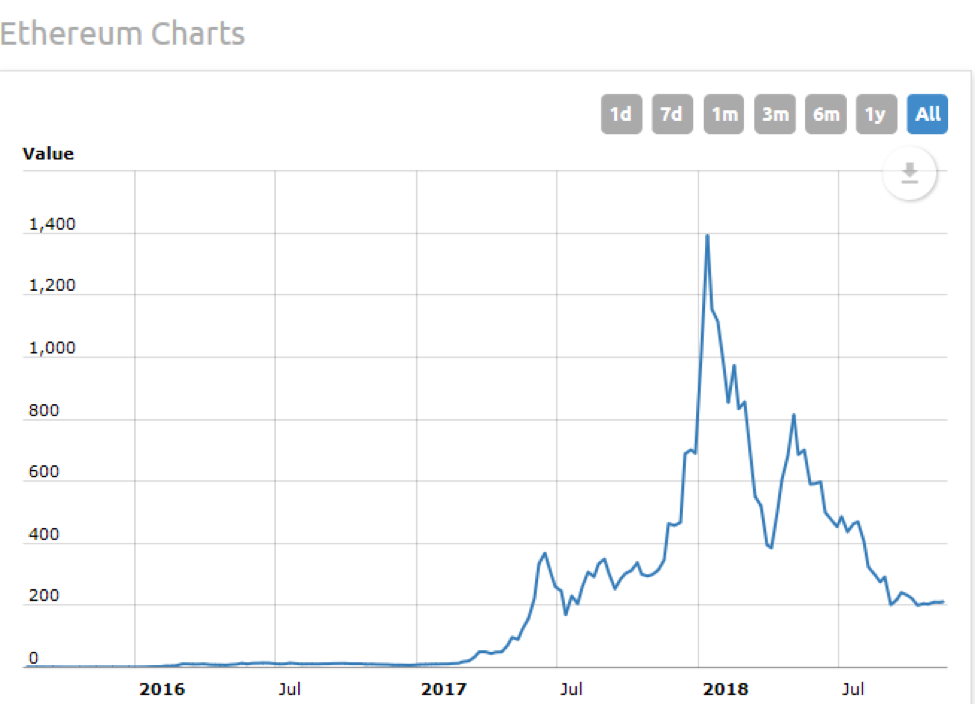

For instance, back in March 2017, one Ether was trading at $30 only. As of March 2018, the same Ether was selling at $750, appreciating with over 2500% within one year. By December 2017, Ether was valued at $1350. This means that anyone who invested $1000 in Ether in March 2017, by December 2017, his Ethereum investment was worth $45,000. If you consider investing in Ethereum, below are some tips you can use to maximize your chances of success.

- Do Your Homework

It’s important first to understand the basic principles of working with Ethereum and what’s makes it unique. Just like most cryptocurrencies, Ethereum uses the Blockchain technology and is it’s an open source platform. Doing in-depth research will help you understand what you are getting into and avoid any surprises.

The internet is full of materials that can enlighten you about Ethereum. This way, you will be able to make informed decisions when it comes to investing. It’s also vital to consult a professional expert to advise you on the same. You should keep in mind that cryptocurrencies industry offers a rare and unique opportunity but it’s also highly speculative and unregulated, and therefore it should be treated accordingly.

- Buy and hold

This is another useful and common investment practice for Ethereum. In fact, many financial experts advocate for this strategy including Warren Buffet. However, you shouldn’t hold for too long bearing in mind the volatility of cryptocurrencies. Sometimes prices tend to go up and down very quickly, and it may require you to jump in fast. According to Eliosoff, an investment expert, the right strategy for investing in cryptocurrencies is to buy and forget.

Remember not to fall for FOMO-the fear of missing out. For instance, it’s never a good idea to jump in when something is at its hottest. For example, anyone who bought Ethereum at its highest price of about $1400 is already making losses. However, an investor who bought Ether during its initial pre-sale when it was going for $0.30 and held it up to January 2018, he would have sold it for $1400.

Author’s Snapshot of Ethereum price movement and price history. Woldcoinindex Data.

- Diversify

Given the volatility of the cryptocurrency industry, diversity is the key to minimizing risks. Simply, diversification is coming up with a portfolio where if there is a decline in one component, then there will be an equal gain in another. Even though it’s highly unlikely that Ethereum can disappear anytime soon, it’s important to consider other factors.

Don’t simply be tempted to invest all your money on one cryptocurrency just because it has a steady stream of stories about how it has made many investors millionaires. Investments experts advise against putting all your eggs in one basket. You may end up losing if the coin crashes. Also, it’s highly likely that if one currency loses by about 10%, another one rises by the same amount. Additionally, remember to invest only that amount you are willing to lose.

- Learn how to store your Ethers properly

It’s vital to learn how to protect your digital assets properly. In this case, you must ensure that your Ethers are comprehensively guarded against any threat of scammers and cyber-attacks. While you may consider storing your Ethers in an exchange platform, it’s not the best place to secure your coins.

In fact, all financial experts emphasizes that you shouldn’t store your coins on an exchange. Cold wallets or hardware wallets are the best places to store your coins. In addition, you can take further action by using both online and cold wallets.

- Accept and prepare that Ethereum is volatile

If you decide to invest in Ethereum, remember that it’s notoriously volatile. And you should keep in mind that the Ethereum investment will be very bumpy. No wonder many of us are scared to invest in cryptocurrencies. Be prepared to adopt a risk management strategy that will help turn this risky investment into a profitable choice. Before investing in Ethereum it’s essential to analyze its price trends and find out if it’s the best option to make.

Conclusion

It’s important to feel safe and the best way to ensure that is by trusting your gut. If you feel comfortable to invest in Ethereum, then go ahead. But if you feel uncomfortable putting your money in Ethereum investment, then it may not be the best decision for you.

We can’t predict for sure what will happen tomorrow especially bearing in mind the extreme volatility of cryptocurrencies. However, the fact that Ethereum still has a lot to offer and it’s still in its early stages, it is a good idea to go for it. However, to succeed, you must make well-informed and smart decisions.