Your employer is worried about your balance sheet.

“Financial wellness” — or improving the overall health of their workers’ finances — will be front and center for companies this year, according to a recent survey from Callan.

The investment consultancy polled 106 employers in October 2018.

“Investing” and “retirement plan contribution levels” round out the top three for company communication topics with employees, Callan found.

“The benefits picture has evolved,” said Jana Steele, senior vice president in Callan’s defined contribution consulting group. “It’s a competitive advantage and it helps with attracting and retaining employees.”

Here’s why your boss is suddenly taking a bigger interest in your wallet.

Losing sleep

When bills are keeping you up at night, it takes a toll on your mental health.

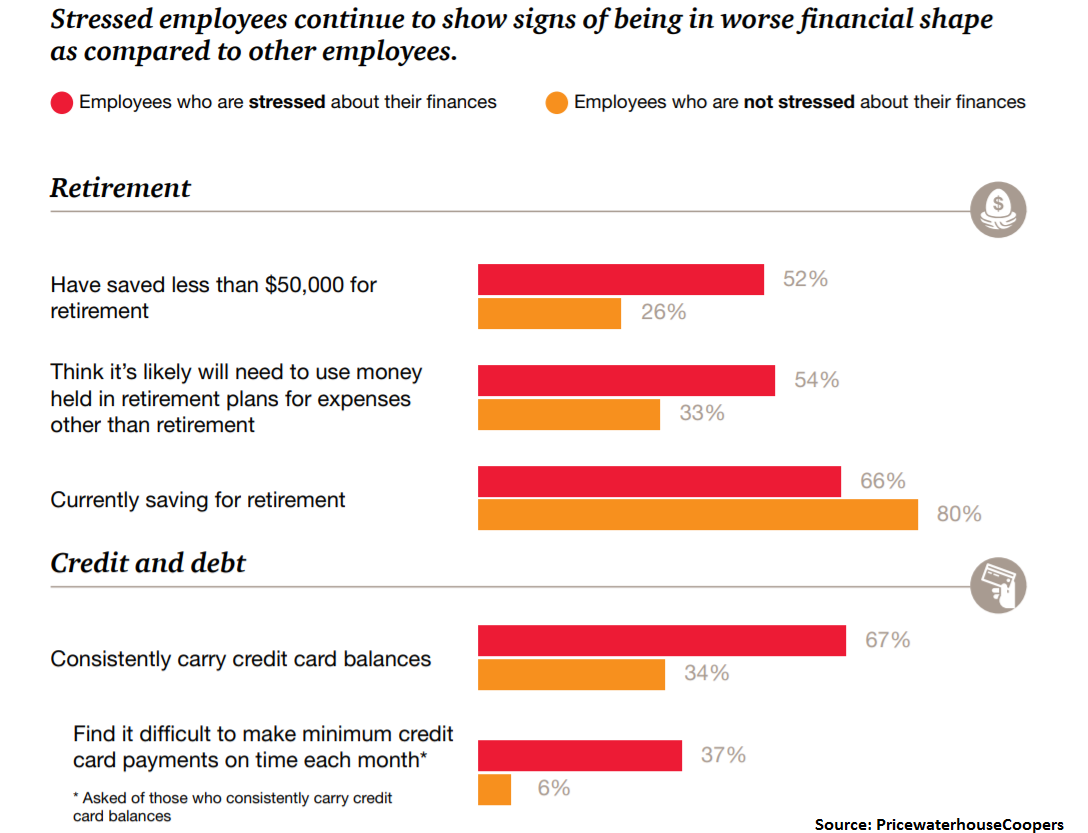

Close to half of employees polled by PricewaterhouseCoopers said that they are experiencing stress over their finances. The firm polled 1,600 working adults in February 2018.

Their fear isn’t unfounded.

“Looking at it from a health perspective, the cost of stress is almost as high as someone who smokes,” said Steele of Callan.

About half of employees who say they’re stressed have less than $50,000 saved for retirement, PricewaterhouseCoopers found. Two out of three say they’re consistently carrying credit card balances.

Help at work

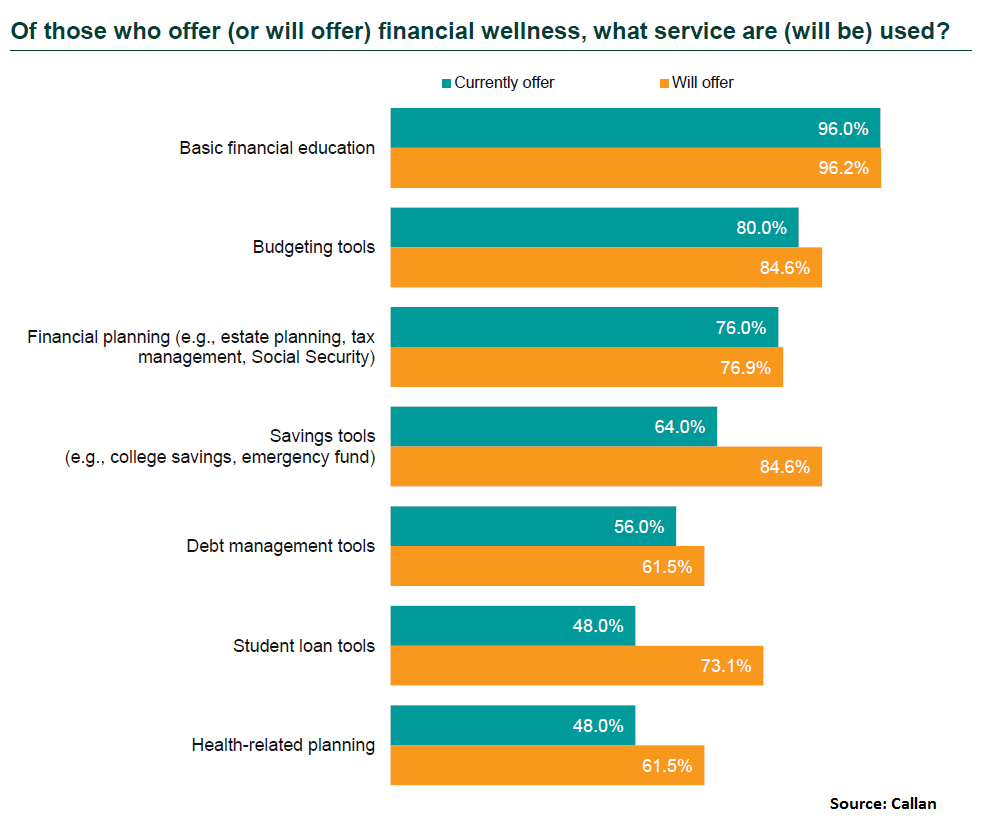

In all, almost a third of the employers Callan surveyed said they offered financial wellness services in 2018, up from 17 percent in the prior year.

Among those who will offer wellness programs, 96 percent said they will focus on basic financial education and nearly 85 percent said they would offer budgeting or savings tools, Callan found.

In addition, 73 percent of that same group said they would provide “student loan tools.”

Some employers have adopted plans to help workers who are grappling with debt.

For instance, Abbott introduced its Freedom 2 Save Plan: Employees who put 2 percent of their pay toward their student loans will receive a 5 percent “match” into their 401(k) plan account.

It could be awhile before these wellness solutions become commonplace among employers, Steele said.

“For defined contribution plans, we don’t see movement unless there is a driver around it: regulation, litigation or legislation,” she said.

[“source=cnbc”]