U.S. business investment is finally showing signs of life, and the Federal Reserve may have to reconsider its low-and-slow approach to raising interest rates if such spending becomes a vital force for the economy.

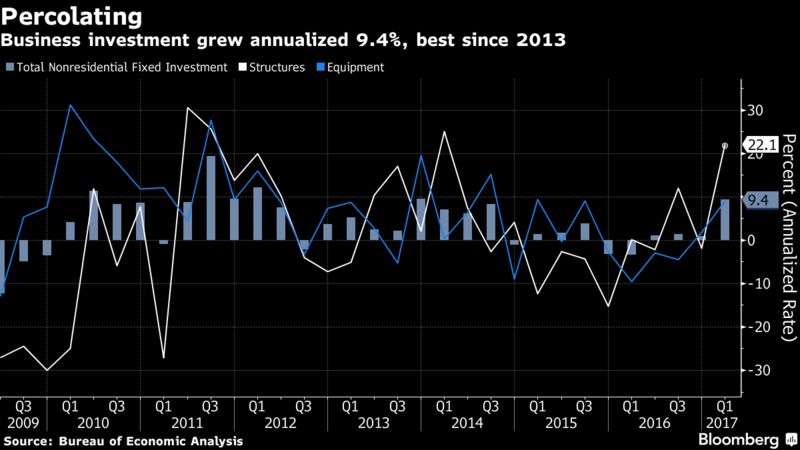

Underneath a weak reading of first-quarter gross domestic product on Friday, non-residential investment in structures, equipment and intellectual property grew at a 9.4 percent annualized pace, the fastest since the fourth quarter of 2013. While the Bureau of Economic Analysis attributed the increase to a significant jump in “mining exploration, shafts, and wells” — which reflects a surge in oil-and-gas drilling — almost all categories of investment showed gains.

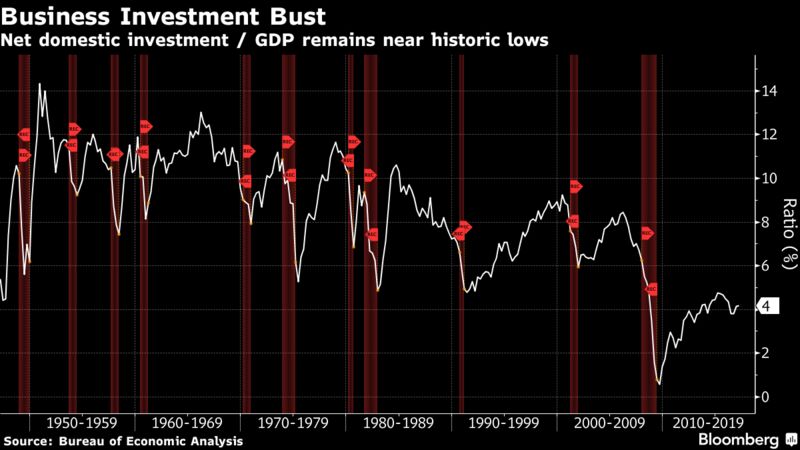

Business spending has been the great laggard of the expansion and one reason why U.S. central bankers estimate the economy’s growth potential at 1.8 percent over the long run. Consumer spending, which accounts for 70 percent of GDP, is likely to reboundafter last quarter’s slowdown.

If President Donald Trump’s promised tax cuts, or even a steady rise in confidence, causes companies to boost capital spending, the economy’s speed limit will rise as workers produce more with new and better tools.

Such a shift would challenge a key assumption among Fed officials, who currently expect the economy to grow around 2 percent over the next three years. The risk is that the Federal Open Market Committee misses the economy’s acceleration onto a faster path, and allows monetary policy to remain too easy for too long.

“We have lulled ourselves into this view that growth is slow and productivity is low,” said Torsten Slok, chief international economist at Deutsche Bank AG. The risk that the Fed is falling behind the curve on interest rates is “what keeps most FOMC members sleepless at the moment.”

FOMC Meeting

U.S. central bankers meet on Tuesday and Wednesday in Washington. Investors are pricing in about an 85 percent chance that the committee will leave its benchmark rate unchanged in a range of 0.75 percent to 1 percent. They see a roughly one-in-two chance the Fed will deliver a projected three rate increases this year. The FOMC has only raised the benchmark lending rate three times since the expansion began in mid-2009, including at their March meeting.

A sustained pickup in business investment is a big question mark. There are many reasons to question a forecast of a sudden burst of productivity fueled by a capital-spending boom, said Michael Gapen, chief U.S. economist at Barclays Plc. The biggest determinants of business spending, he said, are current and past economic activity. In other words, it takes a lot to shake expectations in executive suites that tomorrow’s economy will be faster than the 2 percent growth they’ve seen in recent years.

A sudden boom in capital spending and faster productivity “is certainly not our baseline and it looks implausible,” Gapen said.

Businesses have been so tight with spending, however, that something may eventually have to change. The age of private fixed assets in the U.S. is 22.4 years, the oldest since 1955. Also, corporate balance sheets are in good shape and can support more investment, Deutsche Bank’s Slok said in a recent report.

On top of that, business surveys are showing more confidence and economic data are indicating more signs of a pickup.

Orders for non-military goods excluding aircraft, a proxy for business investment in equipment, rose an annualized 6 percent in the first three months of the year, Commerce Department data showed Thursday. That was the best quarterly performance for bookings since the third quarter of 2014. The new orders index in the Chicago purchasing managers’ index released Friday rose to 65.9 in April from 60.4 in March, according to an email to clients from RDQ Economics in New York.

Components of the Business Roundtable’s CEO Index also moved higher in the first quarter. A measure of the sales outlook for the next six months climbed 21 points to a five-year high of 123.8 in the first quarter. A gauge reflecting plans for capital spending advanced 18.4 points to an almost three-year high.

John Ryding, the chief economist at RDQ Economics, cited a key barometer of underinvestment in recent years: capital stock, relative to the amount of labor corporations are using, has been growing at below its historic 3 percent pace. Lately, there has been little change in the capital-to-labor ratio, he says, which he attributes to corporate tax rates in the U.S. that have remained high while rates abroad have fallen.

Commerce Secretary Wilbur Ross said in a statement on the GDP report that business and consumer sentiment are strong, “but both must be released from the regulatory and tax shackles constraining economic growth.”

U.S. tax reform could change incentives, and “there is a risk of a pickup in productivity and therefore potential GDP growth,” Ryding said. But the Fed would be unlikely to front-run their strategy of gradual policy tightening, he said, which includes just three hikes next year.

“They would just go farther” as their estimate of the neutral rate of interest — that keeps supply and demand in the economy in balance — rises from their current view of 3 percent.

“There are many things that cause them to pause, and there are fewer things that can cause them to accelerate,” Ryding added.

[sOURCE:-BLOOMBERG]