Mumbai: Subdued loan growth, high provisioning on large accounts and corporate tax conversion could weigh down on bank earnings in the quarter ended December.

Lumpy recoveries mainly from Essar Steel could lead to large corporate banks reporting better write-backs, but bulk of the money could be used to bump up provisions in case of fresh slippages.

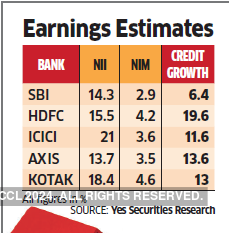

“Many banks may witness an increase in their gross non-performing loan ratios though delinquencies are expected to largely come from the known stress pool for corporate lenders,” said Rajiv Mehta, lead analyst, Yes Securities. “Credit cost to be sequentially lower for SBI and ICICI due to Essar Steel write-backs.”

Fresh corporate bad loan formation is likely to remain elevated in Q3 due to the recognition of stress in DHFLNSE -0.59 %, Reliance Home and Commercial Finance, Suzlon and CG Power.

Some large corporate groups continue to remain stressed, including Essel Group and Coffee Day. Recent additions include Vodafone, Altico, Omaxe, Peninsula Land and Karvy. Together, these may lead to a heavy corporate stress pipeline unless the accounts are resolved. Resolutions, too, have gathered pace with longpending Essar Steel finally getting resolved after the Supreme Court verdict, apart from Ruchi Soya, Prayagraj Power, RattanIndia Amravati and Coastal Energen.

“Corporate banks are likely to report stable/better margins and lower NPAs, mainly due to lumpy NPA resolution including Essar Steel,” said Anand Dama, senior research analyst at Emkay Global. “Most private banks have migrated to the new low tax rate regime with deferred tax asset (DTA) impact largely factored in Q2, and these private banks will benefit in Q3 due to lower tax provisions.”

As per the latest RBI data, credit build-up in the banking system was modest during Q3, leading to a year-on-year deceleration in credit growth. Gross non-food credit growth also showed sharp moderation at 7.3 per cent in November as against 13.8 per cent in the year-ago period.

Decelerating system credit growth, muted margins and fee income are likely to lead to a moderated operating profit growth of 12 per cent, estimates ICICI Securities.

[“source=economictimes”]