Trade talks and the latest data on U.S. employment will color the week ahead for the stock market, CNBC’s Jim Cramer said Friday as stocks rallied on high hopes for a U.S.-China trade deal at the weekend’s G-20 summit.

President Donald Trump is planning to meet with Chinese President Xi Jinping at the Buenos Aires, Argentina gathering on Saturday to discuss what has amounted to an ever-escalating trade war between the two nations. Next Friday, a Labor Department report on U.S. job creation will bookend what Cramer expects to be an “exciting” week for stocks.

“Between Trump’s meeting with President Xi over the weekend and the employment number on Friday, there’s a whole lot going on next week. Let’s just hope it’s not too exciting,” the “Mad Money” host said.

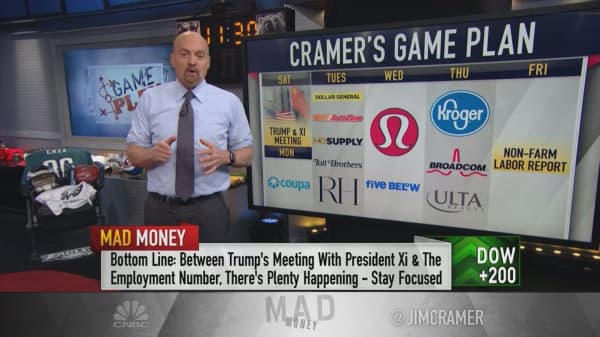

With Saturday’s market-defining meeting in mind, Cramer turned to his game plan for the week ahead:

Monday: Coupa Software

Spending-focused cloud player Coupa Software reports earnings on Monday. The Federal Reserve’s slight step back from its initial plans for raising interest rates created a better environment for growth stocks like Coupa’s, Cramer said.

“Speaking of the Fed, I sure wish they’d start thinking not just about the raw data interpretation, but also about outfits like Coupa, which save companies a fortune … by cutting back on people — the most expensive part of a business — and allowing them to rely on software to handle procurement,” he said.

“That means all of these cloud-based enterprise software companies are inherently deflationary,” Cramer continued. “So [Fed Chair Jerome] Powell might want to listen in on Coupa’s conference call, which, by the way, I expect to be a good one.”

Tuesday: Dollar General, Autozone, HD Supply, Toll Brothers

Dollar General: Cramer expected a strong earnings report from Dollar General, which will issue its quarterly results Tuesday morning.

“The best-performing portions of retail this week were the bargain basement operations: Ollie’s, TJX and Burlington Stores. Dollar General fits that bill,” he said. “I see an upside surprise coming.”

Autozone: Auto parts retailer Autozone will also report earnings. Cramer is a fan of the company’s share buyback program, which he said was as good a reason as any to buy Autozone’s stock after its report.

“Even if the company delivers slightly off numbers, just a little bit of slippage, it’s usually a great buying opportunity,” he said. “These days, people are keeping their cars longer and longer, which means they need more maintenance and spare parts, a real boon to all of these … auto parts companies.”

HD Supply: HD Supply’s earnings will give Cramer a sense of how small businesses are faring in this country because the company provides industrial services to roughly 500,000 smaller-scale professional customers.

“It’s all part of the pastiche that I like to put together to take the temperature of the economy in real time,” he said.

Toll Brothers: Homebuilder Toll Brothers will add to that pastiche. Cramer expected the company’s earnings report to “tell a tale of both strength and weakness.”

“Remember, I’m not saying the economy overall is weak, I’m saying it’s weaker than it’s been, and one of the reasons is the slowing housing market,” he explained. “I bet Toll confirms my view, particularly on the coasts.”

Wednesday: Lululemon Athletica, Five Below

Two Cramer-fave retailers, Lululemon and Five Below, will report earnings on Wednesday. The stocks of both companies have been struggling of late, Lululemon’s “in sync with … the rebellion against high-priced apparel” and Five Below’s on worries about trade with China, Cramer said.

“I think both sell-offs are overblown at this point,” he argued. “However, I’m mindful of how hard it is to own retailers right now, [now] that people think the economy’s shifting to a lower gear.”

Thursday: Kroger, Broadcom

Kroger: The largest U.S. supermarket chain will also issue its quarterly results. The “Mad Money” host harbored concerns about the company’s slew of formidable competitors.

“While I think, certainly, that Kroger can spin a good yarn about remodeled stores, that merely makes it an OK house in a very bad neighborhood,” he said. “I’m going to have to say no, thank you.”

Broadcom: After Wednesday’s closing bell, investors will get results from chipmaker Broadcom. Cramer said there was a lot to be learned from the company’s conference call.

“I want to know about its quizzical acquisition … of a software company called CA that works with mainframes, not to mention the exposure to China, 5G and Apple, although the latter is not to be named,” he said. “At most, you make some cryptic reference, say, [to] a major customer. Still, there’s a lot to learn from Broadcom.”

Friday: Non-farm payrolls

On Friday, Cramer will be eyeing the U.S. Labor Department’s non-farm payroll report, which measures job creation and is a key indicator for the Fed when it comes to raising interest rates.

“I think it will give us our last strong set of employment numbers — because I think it’s tailing off — giving the Fed [the] justification … that it needs for one more tightening, December tightening, before it waits to see how its rate hikes have impacted the economy,” Cramer said. “Now that Powell has chosen prudence over dogma, there’s a good chance this once red-hot economy can get the soft landing that it so sorely deserves.”

[“source=cnbc”]